By Evan Lange

By Evan Lange

Before proceeding, please review the legal disclaimer.

When dealing with trust assets unequally distributed after dollar distribution, beneficiaries may question whether the distribution was fair, accurate, or legally sound. While some trusts are designed to provide equal distributions, others may allocate assets based on specific wishes of the grantor, tax considerations, or unique beneficiary needs.

At The Lange Firm, led by Evan Lange, we help families in Houston, Texas, navigate the complexities of trust administration, probate disputes, and estate planning. Whether you are a trustee managing distributions or a beneficiary questioning asset allocation, understanding how trust assets are handled after dollar distributions is essential.

Learn more about our probate and trust services here.

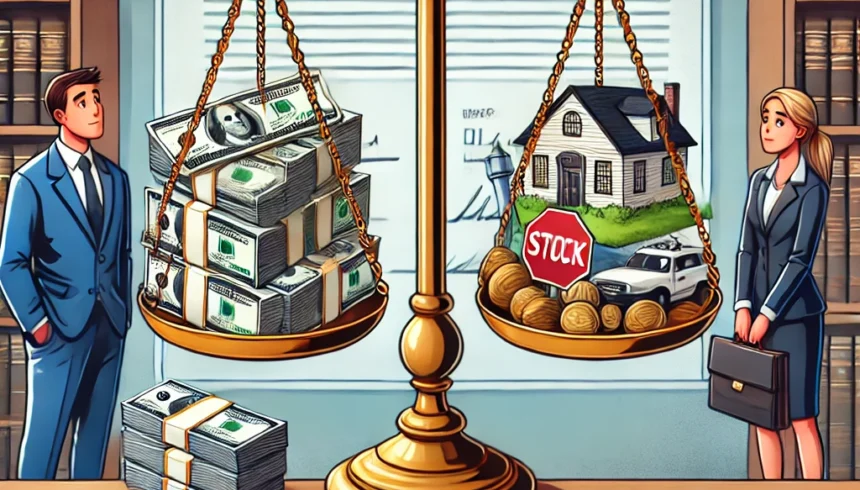

A trust is a legal entity that holds assets on behalf of beneficiaries. When a trust directs a dollar distribution, it means that beneficiaries receive specific monetary amounts, rather than an equal percentage of the overall trust assets. This can lead to unequal distributions of non-cash assets such as real estate, stocks, and business interests.

For example, if a trust holds $500,000 in cash and $1 million in property, two beneficiaries may each receive $250,000 in cash, but one might receive an additional real estate asset while the other does not. While the dollar amount distributed from cash assets may be equal, the overall value of each beneficiary’s inheritance could be unequal.

There are several reasons why trust assets may be unequally distributed after a monetary payout:

Understanding these factors can help trustees and beneficiaries make sense of unequal trust distributions and determine whether they align with the grantor’s intentions and legal requirements.

Yes, a trustee has discretion in distributing trust assets, but they must follow the trust’s terms and act in the best interests of all beneficiaries. If the trust permits unequal asset distributions, the trustee must ensure fairness and transparency.

However, a trustee cannot arbitrarily favor one beneficiary over another unless the trust specifically grants that authority. If a beneficiary believes they were wrongfully shortchanged, they may have grounds to contest the trust distribution in probate court.

When trust assets are unequally distributed after dollar distribution, disputes may arise among beneficiaries. The most common legal conflicts include:

Beneficiaries who suspect mismanagement or unfair treatment can challenge the distribution through probate litigation. However, not all unequal distributions are improper—many trusts are intentionally structured this way.

To minimize disputes, trustees and beneficiaries should follow these best practices:

For Trustees:

✔ Follow the Trust’s Terms – Always adhere to the trust document when making distributions.

✔ Communicate with Beneficiaries – Explain why assets are distributed unequally to prevent misunderstandings.

✔ Obtain Professional Valuations – Hire appraisers to fairly assess the value of non-cash assets.

✔ Consider Tax Implications – Ensure that one beneficiary is not burdened with a disproportionate tax liability.

For Beneficiaries:

✔ Understand the Trust Document – Read and review the terms of the trust before raising objections.

✔ Request an Explanation – If the distribution seems unfair, ask the trustee for clarification before pursuing legal action.

✔ Consult an Attorney – If you believe the trustee is acting unfairly, an estate litigation attorney can help assess your legal options.

If you believe that trust assets were unequally distributed unfairly, you may have several legal options:

Trust disputes can be complex and emotionally charged—seeking legal guidance is often the best way to resolve conflicts efficiently.

How The Lange Firm Can Help

At The Lange Firm, we assist Houston, Texas, families with trust administration, probate disputes, and estate planning. Our team, led by Evan Lange, can help with:

✔ Reviewing trust documents to determine whether unequal distributions are valid.

✔ Challenging trustee mismanagement in probate court.

✔ Assisting trustees in properly distributing assets to prevent litigation.

✔ Negotiating trust disputes through mediation.

Learn more about our probate and estate planning services here.

When trust assets are unequally distributed after dollar distribution, it can lead to confusion, frustration, and legal disputes. While unequal distributions are sometimes intended by the grantor, trustees must act fairly and transparently to avoid legal challenges.

Beneficiaries who believe they were treated unfairly should first review the trust document, seek clarifications from the trustee, and, if necessary, pursue legal action to ensure a fair outcome.

If you are facing a trust dispute or need estate planning guidance, consulting an experienced Houston probate attorney can help protect your rights and resolve conflicts effectively.

Follow our newsletter to stay updated.

2025- The Lange Firm all rights reserved.

Mr. Evan B. Lange is the attorney responsible for this website. | All meetings are by appointment only. | Principal place of business: Sugar Land, Texas.

The information you obtain at this site is not, nor is it intended to be, legal advice. You should consult an attorney for advice regarding your individual situation. We invite you to contact us and welcome you to submit your claim for review. Contacting us does not create an attorney-client relationship. Please do not send any confidential information to us until such time as an attorney-client relationship has been established.